It’s great that we’ve raised awareness and have mobilized addressing mineral supply issues, but is there anything built into these for the long term?

__________

There has been no shortage of commentary and coverage of China’s dominance over the critical mineral and rare earth supply chains. Actions have even been taken to secure domestic or allied supply chains in response.

But what about after the knee-jerk reactions? What systems and frameworks should be in place to reduce these risks moving forward?

Here, I propose a few ideas and strategies that have been employed in similar situations historically to frame up a few options for today’s critical minerals issue.

The SPR

The 1973-74 oil embargo cutoff oil exports from OPEC to the United States. Following the economic fallout of this crisis, the US passed the Energy Policy and Conservation Act (EPCA) in late 1975, establishing the Strategic Petroleum Reserve (SPR).

Since its inception, the SPR has been invoked as a key geopolitical and market force, restoring stability to markets, allowing the US to act as a purchaser and seller of crude oil.

Key buying periods include the post-dot com and 9/11 downturn, the post-2008 recession period, and most recently during COVID-19 in 2020, when crude oil prices reach $24/barrel. Key draw down periods included responses to Hurricane Katrina, 2011 supply disruptions in Libya, and a 2022 sale following the Russian invasion of Ukraine.

Critical Mineral Emergence

The emergence of climate change initiatives, carbon dioxide emission reductions, and reduced long term reliance on fossil fuels has initiated an energy transition. This energy transition is characterized by an increase in renewable energy generation capacity (wind turbines, solar arrays), electric vehicle and transportation shifts, and battery storage development. These key infrastructure improvements employ advanced technologies whose manufacturing processes rely heavily on critical minerals as key raw material inputs.

In this way, the energy transition has established critical minerals and the renewable energy and battery storage infrastructure as a new energy dominance strategy.

Clear signals from the private sector underscore this strategic shift. For example, ExxonMobil has recently pledged $30 billion in investment to support its Lower-Carbon Solutions (LCS) business line. A large portion of this investment is ear-marked for projects focused on battery storage. The company is also developing a direct lithium extraction project in Arkansas, and recently acquired Superior Graphite in Kentucky to support a long term push into the battery anodes market.

The emerging importance of critical minerals goes beyond energy strategy. The same minerals enabling the energy transition are also key raw materials for the advancement of weapons systems, AI technology, and other advanced manufacturing industries. JPMorgan Chase announced investments of up to $10 billion into US companies with crucial ties to national security.

Addressing China’s Dominance

The 1970s energy crisis and the subsequent responses and creation of the SPR have established a playbook for the current critical mineral crisis. China has been developing supply, processing, and refining capacity for critical minerals and rare earth elements for decades.

Now, with renewed fervor, the United States and its western allies are attempting to address the immense hole in which they find themselves. Supply capacity, mid-stream processing capacity, and final refining capacity are all anemic in the face of China’s dominance.

Supply is being addressed, with attempts at fast tracking permits and US government stakes in mining projects. The US has finally established a critical minerals list and criteria for evaluating and updating the list on a regular basis. Additionally, the US and Australia recently signed a framework agreement focused on securing supply & investment for critical minerals. Australia has also proposed a strategic critical mineral reserve to be established in 2026.

Mid stream and final refining projects are getting funding and deals. The US Department of Energy (DOE) and US Department of Interior (DOI) have announced several rounds of funding availability and programs in 2025 to development of mineral supply, processing capacity building, and technology development. Though it feels like investing in new technology to tackle this problem now is a bit too little, too late.

Establishing the Strategic Critical Mineral Reserve

Assuming this supply chain is haphazardly established and can bridge the gap, reducing the long term risks of China’s dominance needs to be top priority.

Establishing a Strategic Critical Mineral Stockpile that mirrors the geopolitical and market stabilizing power of the SPR could be a sound approach, having the US Government act as a buyer of REEs and critical minerals that have experienced large price swings. Ironically, this could be one of the best cases for revival of the federal Bureau of Mines. Tack downstream metals processing onto its remit, have it pay a minimum rate in bad times to keep operations running, pay market price in good times to inject some capital into domestic operations. Adjust the burden on the taxpayer accordingly. And eventually, it could act as a constraining mechanism for price action, and a tool for de-risking geopolitical tensions.

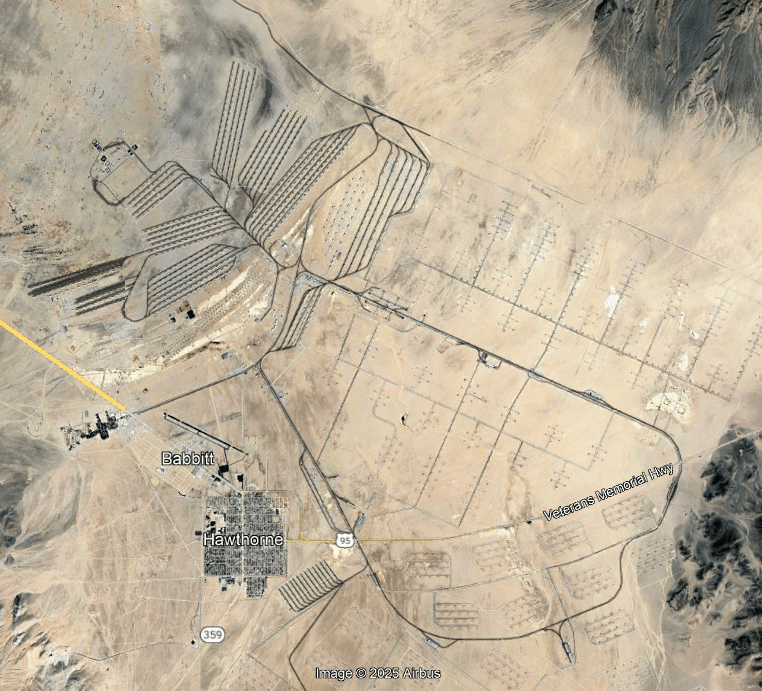

Luckily, the US has taken steps toward establishing such a program. A public-private initiative spearheaded by M2i Global, Volato Group, and the Nevada Governor’s Office of Economic Development is underway at Hawthorne Army Depot in Nevada with support from DOE, the Department of Defense, and the Defense Logistics Agency.

The SPR has served as a foundational strategy in combating OPEC and crude oil-focused geopolitical risk. As the global economy shifts to give critical minerals and REEs a bigger seat at the table, strategies should shift as well.

References

The Strategic Petroleum Reserve

https://www.energy.gov/articles/history-strategic-petroleum-reserve

https://www.energy.gov/ceser/spr-origins

Critical Mineral Emergence

https://apnews.com/article/jpmorgan-chase-ai-security-979f414c93e81d42aa3ca269b14b0c68

China’s Critical Mineral Dominance

https://www.csis.org/analysis/developing-rare-earth-processing-hubs-analytical-approach

The US Critical Minerals List

https://www.federalregister.gov/documents/2025/11/07/2025-19813/final-2025-list-of-critical-minerals

Addressing Critical Mineral Supply Chain Gaps

Establishing the Strategic Critical Mineral Reserve

Leave a comment